Geneva: a mature and structured market

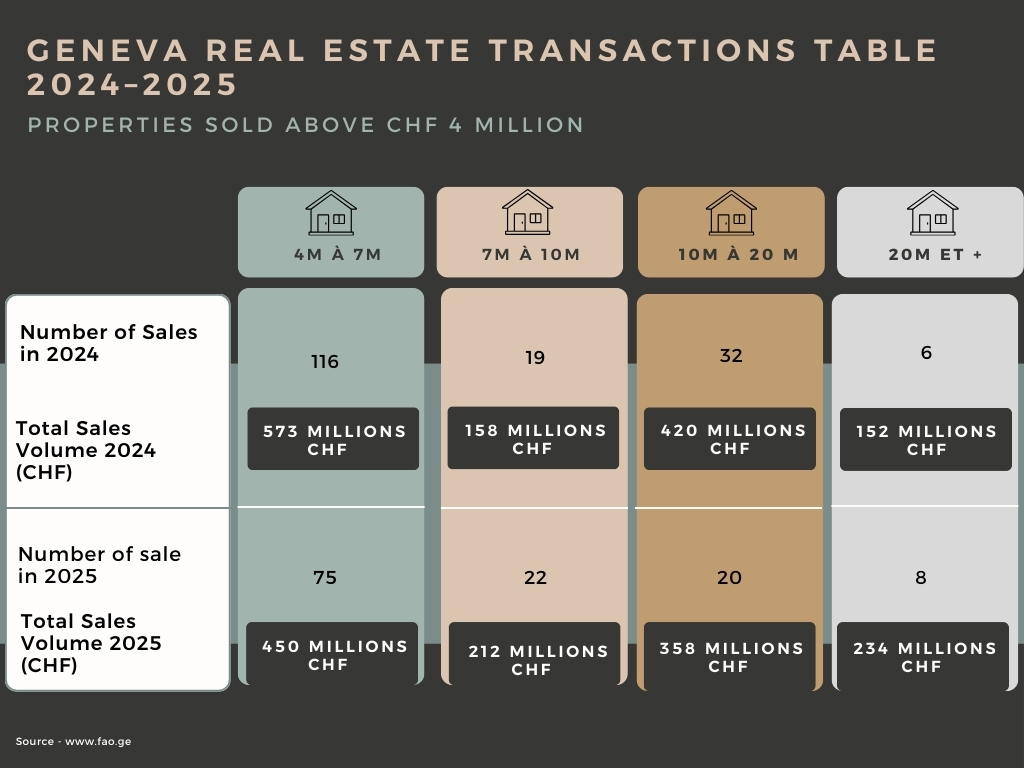

The prestige property market in Geneva remains one of the most robust in Europe. Average prices in the prime segment range between CHF 18,000 and CHF 25,000 per square metre. Between 2024 and 2025, 329 transactions above CHF 4 million were recorded, representing approximately CHF 2.568 billion invested over a one-year period.

Market dynamics are primarily driven by the scarcity of available properties in the most sought-after locations, particularly Cologny, Collonge-Bellerive, Geneva city centre, and the lakefront. Structural land constraints limit the volume of available assets, thereby supporting long-term value stability.

Buyers are increasingly attentive to the intrinsic quality of each property, including precise location, energy performance, level of renovation, and pricing consistency. Accurately priced properties transact within controlled timeframes, while overvalued assets require repositioning.

Canton of Vaud: controlled growth in the high-end residential market

The canton of Vaud has established itself as a complementary market to Geneva, with a stronger residential and family-oriented profile.

The most sought-after areas include Lausanne, La Côte, Montreux, and the Terre-Sainte region. These locations benefit from sustained demand from both domestic buyers and international purchasers with long-term wealth preservation objectives.

The Vaud market demonstrates healthy liquidity for well-located and correctly positioned properties. However, increased buyer selectivity penalises assets with shortcomings in location, quality, or pricing.

The balance between quality of life and accessibility remains a key driver of attractiveness.

Alpine real estate: constrained supply and sustained value growth

Premium Alpine resorts such as Verbier, Crans-Montana, and Gstaad rank among the most expensive markets in the world on a price-per-square-metre basis.

The regulatory framework, particularly restrictions on secondary residences, significantly limits supply. This structural constraint supports long-term capital values.

Gross rental yields remain moderate, generally ranging between 2% and 3%. However, capital appreciation since 2019 is estimated between +25% and +30%, depending on location and property quality.

Ski-in/ski-out chalets, prime central locations, and properties with unobstructed views remain the most liquid segments.

2026: a demanding yet secure market

In 2026, prestige real estate in French-speaking Switzerland shows no speculative dynamics. It operates within a wealth-preservation framework built on stability, scarcity, and capital protection.

Asset performance now depends more on precise positioning than on overall market trends. Detailed micro-market analysis, mastery of real transaction benchmarks, and rigorous property valuation have become essential.

In this context, SPG One – Christie’s International Real Estate supports buyers and sellers across the most demanding markets in Geneva, the canton of Vaud, and the Swiss Alps, with an approach grounded in local expertise and tailored advisory.

Luxury real estate in French-speaking Switzerland remains one of the most structured and resilient segments in Europe, characterised by controlled growth and strong value preservation capacity.

By Maxime Dubus